Table of Content

Once you’ve made an offer on a property, you should check with your mortgage broker or lender and get the home valued. This will confirm that the price you’re planning to pay is reasonable. After this, you will need to work out which type of mortgage you need and share your documents. These will include a copy of your passport, proof of residence, proof of funds for your downpayment, and salary slips confirming your income. When buying a property in Frankfurt am Main the notary fee is usually a maximum of 2% of the property price, an amount that remains constant throughout Germany.

For a mortgage in Frankfurt am Main, the additional purchase costs are 10,98% or 8%, depending on whether you have to pay a real estate agent's commission or not. This is because the bank pays for the security of a long fixed-interest period of 20 years, for example, by charging a higher interest rate. But if you plan to live in the property in Frankfurt am Main for only ten years and then sell it, your loan will cost you more than necessary. If, on the other hand, you plan to live in your home for twenty years, you should fix the interest rate for longer. Assuming it expires after ten years, you will need follow-up financing.

Loan-to-value

It has a variety of loan options and emphasizes approving and closing loans fast. With eClose, you can offer your borrowers with eligible loans the ability to review and sign all closing documents online, from the comfort of home – or wherever they may be. Under certain conditions, it is also possible to finance a mortgage in Frankfurt am Main without equity. These conditions include, for example, a very good credit rating, a very high income, and an excellent location of the property.

While interest rates were around 6.5% in 2000, they have settled at around 1% in recent years. The low interest rates are a great advantage for buyers since the cost of the loan is rather low compared to the past and you can borrow money cheaply. They failed to pay our property taxes and a lien has been placed against our home. They deducted $1444 from our escrow account but given no explanation as to our moneys whereabouts. We can not get through to anyone in their escalation department. We have called and left messages numerous times since mid May and have yet to receive one returned call.

Trying to get a payoff letter and waiver of late fees

Like many mortgage brokers, we get paid by the German lender banks. Unlike many brokers, we won't charge you any fees for our services. The lender or broker you work with will provide an estimate of all loan costs and fees after you apply. Closing costs can cost as much as 5% of the purchase price of your home. Costs and fees are included in your Plaza loan annual percentage rate ; when comparing loans, the APR is a better indicator of loan costs than the interest rate alone. This means that it deals with brokers and lenders — not directly with borrowers.

When you want to buy a home in Germany, you’ll almost certainly need to take out a mortgage. Thankfully for expats, German banks and other lenders offer a range of mortgages, including fixed-term and variable rate deals. Keep reading for advice on the types of mortgage, how to apply for one, and the fees you might need to pay.

We can't thank LoanLink24 enough

Unlike most brokers, we have integrated multiple banking platforms, which gives us the widest coverage in Germany. This is how we know exactly what is out there and can feed these conditions into the recommendation engine. “We had a fantastic experience negotiating the complexities of the German banking system with Basar's help.

They said I didn't have any but I did and have the proof that I emailed around 3 time. I kept getting told they see the error and that it will be fixed, the next 2 months pass I continue to get a letter stating I don't have insurance. This review was chosen algorithmically as the most valued customer feedback. 7 Plaza Home Mortgage reviews first appeared on Complaints Board on Jun 17, 2008. Plaza Home Mortgage has an average consumer rating of 1 stars from 7 reviews.

We help you understand German home loan better

In 2022, rates have increased, making refinancing less common among homeowners. Plaza Home Mortgage (NMLS #2113) is a wholesale and correspondent lender offering Freddie Mac, Fannie Mae, FHA, VA land USDA loans in all 50 states. It’s headquartered in San Diego, California, and has offices in Arizona, California, Colorado, Florida, Hawaii, Illinois and Oregon. When you come to the end of your fixed term, you will need to refinance your mortgage . This involves switching to a new mortgage with your current bank or a different provider.

For example, if you fix for five years at a rate of 2.5%, you might expect to pay 2.8% if you fix for 10 years, or 3.1% for 15 years. As mentioned above, Germany has a low homeownership rate, with many residents choosing to rent instead of buying a home. This means it might be prudent to consider renting when first moving to Germany, giving you time to decide whether to buy a property and where to choose. Mortgages are readily available, as long as you can meet criteria on earnings and have a sufficient down payment. Data from Statista shows that Germany was one of only three European countries to have more than a trillion Euros of outstanding mortgage balances in 2021.

Plaza offers a wide variety of online and electronic services for your business so you can operate as efficiently as possible. And with our renowned client service, you can count on having the support you need, when you need it. They combine advanced algorithms to tailor the right mortgage product to your personal circumstances. Unlike most comparison websites, they do not solely focus on the cheapest product, but on the product that is right for you, ensuring long-term financial security. To find the best mortgage for you, we compare offers from more than 750 lenders and their conditions across Germany. Mortgage rates in Germany are usually calculated based on the risk that the borrower will not repay the loan.

German mortgage calculator Use the calculator to understand your mortgage repayment options. Our team of experts will find you the optimal mortgage in Germany online. Our advanced technology compares mortgage options from over 400 German lender and our mortgage experts will explain each offer. Companies displayed may pay us to be Authorized or when you click a link, call a number or fill a form on our site. Our content is intended to be used for general information purposes only. Since june of 2020 I have been having issues with homeowner insurance.

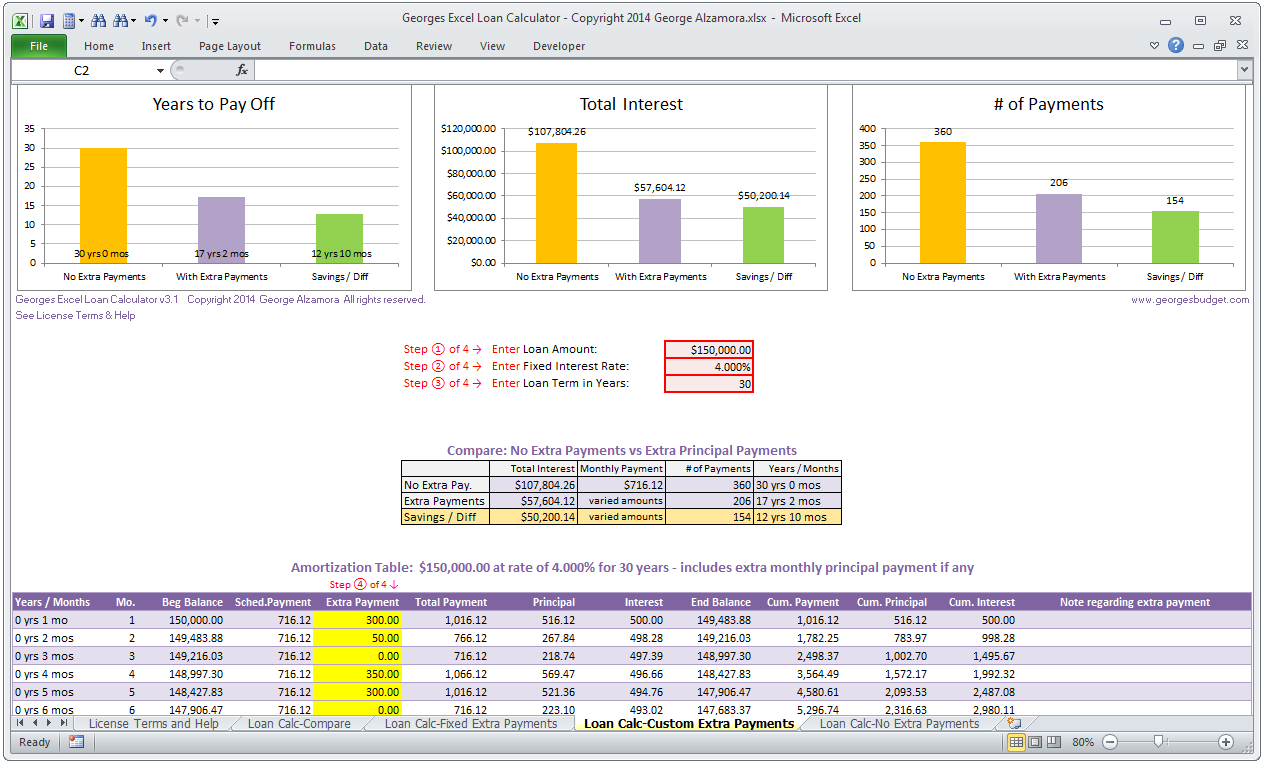

As mentioned earlier, your mortgage lender may allow you to make higher payments to reduce your balance more quickly. Mortgage lenders in Germany will usually charge a fee for processing your application. In many cases, this will be built into the rate you pay, rather than an up-front lump sum. As elsewhere in Europe, German mortgage rates have been very low for much of the last decade. However, an increase in European Central Bank interest rates in 2022 has brought about higher rates. You can find the latest Bank Lending Rate in Germany on the Trading Economics website, which is updated monthly.

Due to the many different factors that influence the interest rates for a mortgage in Frankfurt am Main, it is important that you receive individual consultation. Our experts are on hand to give you all the advice you need and help you find the optimal construction financing. “Simply put, my wife and I would not have our dream home without the help of LoanLink and Başar. Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. If you live and work outside of Germany, you’ll usually only be able to borrow around 60% of the property’s value, meaning you’ll need a deposit of at least 40%. Germany’s property system encourages investment in the rented sector, with favorable tax incentives available for residents who purchase buy-to-let properties.

The company is a full-service wholesale and correspondent lender. Once your mortgage is approved, you’ll have around two weeks to sign your contract. After this, you can progress with the other formalities of buying the property . After you’ve exchanged contracts and your notary has set a date to finalize the purchase, you’ll pay your down payment. The mortgage lender will then transfer the remaining money directly to the seller. Mortgages in Germany are generally available with terms of up to 25 or 30 years.

No comments:

Post a Comment